For any professional services firm, time isn't just a resource—it's the product. But if you're still wrestling with spreadsheets, chasing down timesheets, and manually piecing together invoices, you're leaving money on the table. This is the exact pain point that specialized billing software is built to solve. It’s designed to replace the clunky, error-prone manual processes with a single, automated system that handles the entire billing cycle, from tracking time to getting paid.

What Is Billing Software for Professional Services

Think of the all-too-common scenario: a consultant spends hours after a long day trying to remember every billable minute, matching expenses to projects, and hoping no mistakes slip through. This isn't just inefficient; it's a direct hit to your cash flow and profitability. This is precisely where billing software for professional services steps in.

This kind of software acts as the central hub for your firm’s revenue. It's much more than a simple invoice generator. It’s a complete ecosystem that intelligently links the work your team delivers directly to the payments you need to receive, automating the tedious administrative work so you can focus on what you do best: serving your clients.

From Manual Effort to Automated Efficiency

Making the switch from manual billing to an automated platform is a game-changer for any service business looking to scale. Let's face it, manual methods are a breeding ground for human error. A forgotten expense, an unlogged client call, or a simple typo can lead to thousands in lost revenue over a year. An automated system catches it all, ensuring every billable moment is accounted for.

Here’s what that transition really means for your firm:

- Eliminating Errors: Automation drastically cuts down on mistakes in time logs, expense tracking, and invoice calculations, which means fewer awkward conversations with clients.

- Saving Valuable Time: Imagine all the hours spent chasing timesheets and building invoices from scratch. That time is now freed up for billable work.

- Accelerating Payments: With features like one-click invoicing and online payment options, you can shrink your payment cycle from weeks to days and seriously improve your cash flow.

- Gaining Financial Clarity: When all your billing data is in one place, you get a crystal-clear view of project profitability, team utilization, and your firm's overall financial health.

This isn't just about adopting a new tool. It’s a fundamental shift in how your firm values and manages its most critical asset—time. By directly connecting time to revenue, this software turns a painful administrative chore into a powerful engine for growth.

The market certainly reflects this demand for smarter operations. The professional services software space, which includes these billing and time tracking systems, recently hit a market size of USD 51.1 billion after an 11.9% year-over-year jump. Projections show it climbing to USD 71.4 billion by 2029, and you can see more on the trends driving this growth on Appsruntheworld.com. The takeaway is clear: firms are ditching outdated methods to become more competitive and efficient.

Key Benefits of Modern Billing Automation

Making the leap from manual spreadsheets to a dedicated billing software for professional services is more than just a simple upgrade. Think of it as a fundamental overhaul of your firm's financial engine. This one move can unlock a wave of powerful benefits that ripple through your profitability, client relationships, and day-to-day operations. It’s all about turning a tedious administrative chore into a strategic asset for growth.

By automating your billing cycle, you effectively patch up common financial leaks, get paid faster, build stronger trust with your clients, and finally get the clarity you need to make smarter business decisions. Let's dig into these four core advantages.

Enhanced Accuracy and Reduced Revenue Leakage

Every professional services firm, big or small, deals with revenue leakage. It's those small, unbilled moments that seem insignificant on their own but add up to a serious loss over time. A five-minute phone call here, a quick email response there—these are billable activities that often slip right through the cracks of any manual tracking system. Automation acts as a crucial safety net, making sure every second of work is captured.

This is usually handled by integrated time tracking tools that log work as it’s happening. For example, a consultant can fire up a timer on their phone the moment a client calls, ensuring even the briefest conversations are recorded and billed for. If you want to dive deeper into this, we cover the importance of precise logging in our complete guide to https://www.timetackle.com/time-tracking-for-professional-services/. This simple change prevents valuable work from being forgotten or lowballed, which directly pumps up your bottom line.

The core idea is simple: if the work was done, it should be billed. Automation ensures this happens consistently, turning forgotten minutes into measurable revenue and plugging the leaks that silently drain profitability.

Accelerated Cash Flow

The gap between finishing the work and seeing the money in your bank account can put a real strain on a firm's finances. Billing automation shrinks this cycle dramatically. Instead of waiting for the end of the month to painstakingly piece together invoices, you can generate and send them off with a single click the moment a project milestone is complete.

This speed boost is powered by a few key features:

- Instant Invoicing: Create professional, detailed invoices from tracked time and expenses in a matter of seconds, cutting out administrative lag time.

- Automated Reminders: Set up a sequence of polite, automatic follow-ups for outstanding payments. You'll never have to personally chase down a client again.

- Online Payment Gateways: Let clients pay you directly from the invoice using a credit card or bank transfer. It’s frictionless for them and faster for you.

When you make it incredibly easy for clients to pay and remove your own internal bottlenecks, you'll see a significant improvement in cash flow. That's the capital you need to keep the lights on and invest in growth.

Improved Client Trust and Transparency

Let's be honest: billing disputes usually start from confusion, not bad intentions. A vague line item on an invoice is all it takes to trigger questions, payment delays, and a slow erosion of trust. Modern billing software tackles this problem head-on by producing invoices that are models of clarity and transparency.

Each invoice can offer a detailed breakdown of every service provided, showing exactly who did the work, when they did it, and what it was for. This level of detail doesn't leave any room for doubt. When clients see a clear, professional, and itemized account of the value you delivered, they’re far more likely to pay promptly and without argument, which only strengthens the relationship. To see how this fits into the bigger picture, you can learn more about cloud-based accounting solutions.

Actionable Business Insights

Perhaps the most strategic benefit of all is the treasure trove of data that billing software provides. It elevates you from simply processing payments to truly understanding the financial pulse of your firm on a granular level. These platforms generate powerful reports that answer the critical questions you should be asking.

And the demand for this kind of clarity is exploding, especially in specialized industries. The global legal billing software market, valued at USD 2.15 billion, is on track to hit USD 4.28 billion by 2034, a surge driven by the intense need for efficiency and transparency. Discover more insights about legal billing software trends on Custom Market Insights. This points to a much broader trend: modern professionals need data to not just survive, but thrive.

Essential Features Your Billing Software Needs

Picking the right billing software for professional services is a lot like choosing the right tool for a job. You wouldn’t use a hammer to drive a screw, and you wouldn't use a basic invoicing app to manage a complex consulting firm. The right choice comes down to your specific needs, and knowing the core features is the first step to making a smart investment.

Not all billing platforms are built the same. Some are little more than digital invoice pads, while others are powerful systems designed to manage your firm’s entire financial workflow. To help you sort through the noise, we've identified the must-have features that every professional services firm should look for.

H3: Time and Expense Tracking

This is the bedrock of accurate billing for any service-based business. Period. If you can't capture time and expenses down to the last detail, you’re leaving money on the table. Think of this as the engine of your billing system—it drives everything else.

A solid time and expense tracking module should include:

- Automated Time Capture: Look for tools that offer mobile timers, desktop widgets, and integrations that let your team log hours as they work, not days later when memory gets fuzzy. This one habit alone drastically cuts down on inaccuracies.

- Receipt Scanning and Management: Your team needs to be able to snap a photo of a receipt on their phone and have the software instantly categorize it and link it to the right project. No more shoeboxes full of paper.

- Approval Workflows: A manager's oversight is critical. The system must allow managers to easily review and approve timesheets and expense reports before they ever make it onto a client's bill.

H3: Invoicing and Billing Flexibility

Once you’ve captured all that billable data, the software has to turn it into a professional, easy-to-understand invoice without a headache. This is where you get paid, so clarity and flexibility aren't just nice—they're essential.

The goal here is to make your invoicing process so smooth and transparent that clients pay you quickly and without question. A great invoice doesn't just ask for money; it builds trust and speeds up your cash flow by eliminating any hint of confusion.

Key invoicing features you should absolutely demand:

- Customizable Invoice Templates: Your invoices are a reflection of your brand. You need the ability to add your logo, tweak the layout, and personalize the message to maintain a professional look.

- Recurring Invoices: For any retainer-based work, setting up automated, recurring invoices is a game-changer. It saves a ton of admin time and keeps your cash flow predictable.

- Multiple Billing Rates: Professional service firms almost never have a one-size-fits-all billing rate. Your software must handle different rates for different people (think partner vs. associate), specific types of work, or even per-project agreements.

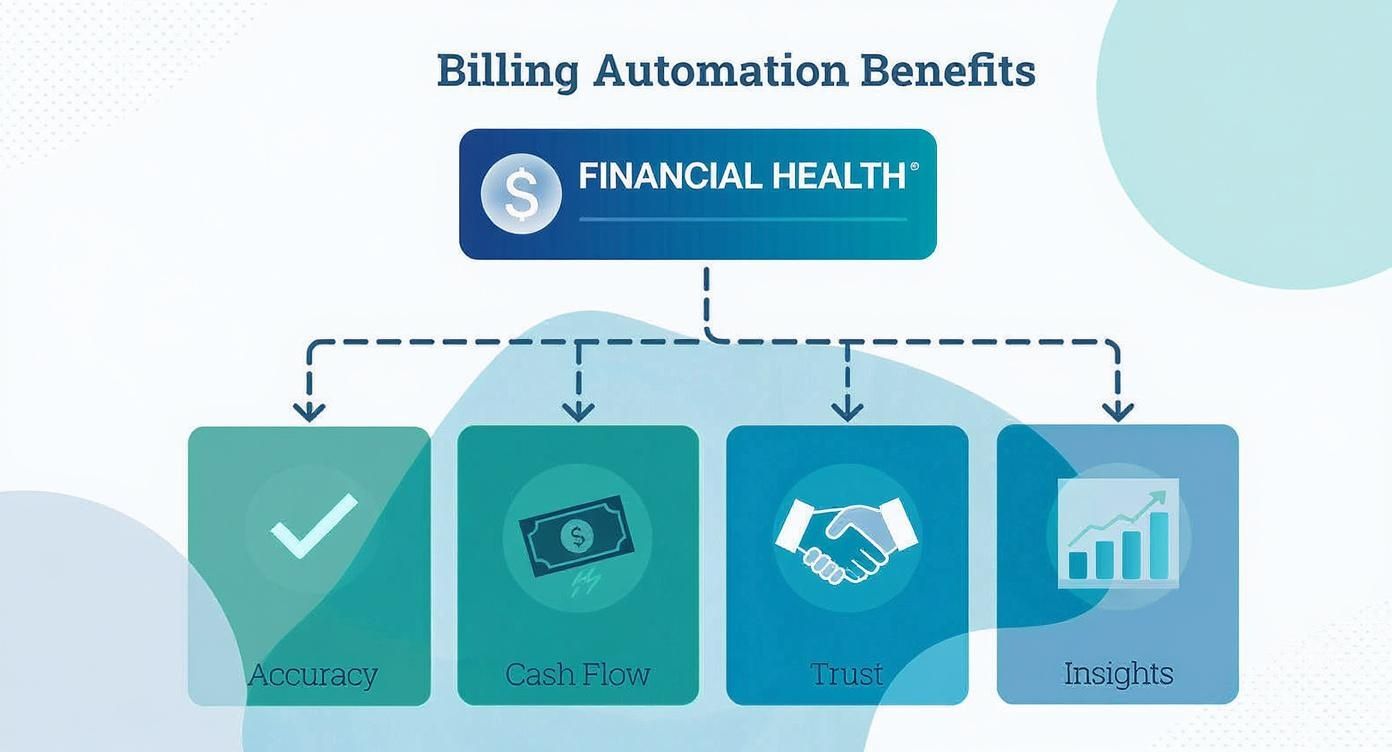

This diagram shows how solid billing automation underpins the financial health of your entire firm by improving accuracy, cash flow, trust, and the insights you can act on.

The image makes it clear: a healthy bottom line starts with accurate billing, which leads directly to better cash flow, stronger client relationships, and smarter business decisions.

H3: Project Management and Reporting

The best billing software for professional services goes beyond just sending invoices. It gives you the insights you need to run a more profitable business. It’s like having a dashboard in your car that shows not just your speed but also your fuel economy and engine diagnostics.

These are the features that empower you to stop guessing and start making data-backed decisions.

- Budget Tracking: Set budgets for your projects and get real-time alerts when you're getting close to the limit. This is your best defense against scope creep and vanishing profit margins.

- Profitability Analysis: The software should be able to instantly generate reports showing you which clients and projects are actually making you money. This is gold for your long-term strategy.

- Team Utilization Reports: Get a clear picture of how your team is spending their time. Are they focused on billable work, or are hours getting lost to administrative quicksand? This report tells you.

To make it even clearer, here’s a quick-reference table breaking down the most important features and why they're so crucial for firms like yours.

Essential Features of Billing Software for Professional Services

| Feature Category | Key Functionality | Why It's Critical for Professional Services |

|---|---|---|

| Time & Expense Tracking | Mobile timers, receipt scanning, and approval workflows. | This is the source of all your billing data. Inaccurate tracking leads directly to lost revenue and incorrect invoices. |

| Flexible Invoicing | Customizable templates, recurring billing, and support for multiple rates. | Your invoices must be professional, accurate, and adaptable to various client agreements (hourly, retainer, project-based). |

| Project Budgeting | Set project budgets, track progress in real-time, and get alerts. | Prevents over-servicing clients and ensures projects stay profitable. It's your first line of defense against scope creep. |

| Reporting & Analytics | Profitability reports, team utilization, and accounts receivable aging. | Moves you from simply billing to understanding your business. It helps identify your most profitable clients and services. |

| Payment Processing | Integrates with payment gateways (e.g., Stripe, PayPal) for online payments. | Makes it easier for clients to pay you, which dramatically speeds up cash flow and reduces the time spent chasing payments. |

Having these core features in place isn't just about efficiency; it's about building a scalable, profitable foundation for your professional services firm.

How to Choose the Right Software for Your Firm

Picking the right billing software for professional services is a lot like choosing a new car. A slick two-seater sports car looks great on the lot, but it’s completely useless for a family of five. In the same way, a generic invoicing tool will quickly fall short for a consulting firm juggling complex projects and multiple clients.

The goal isn't just to find a platform with the longest feature list. It's about finding the one that perfectly fits your firm's specific workflows, growth plans, and team dynamics. A little bit of thoughtful evaluation now will save you from major headaches and costly migrations down the road.

Assess Your Firm’s Unique Needs

Before you even think about watching a software demo, the most important step is to look inward. Every professional services firm has its own operational DNA, its own way of getting things done. What are the real pain points you're trying to fix? A simple checklist can cut through the noise.

Start by asking a few foundational questions:

- Billing Complexity: Are you juggling different billing models at the same time, like hourly, fixed-fee, and retainers?

- Currency Requirements: Do you have international clients? If so, you'll need multi-currency support for both invoicing and payments.

- Workflow Approvals: Does a manager need to sign off on timesheets or expenses before an invoice goes out the door?

- Team Structure: Is everyone in one office, or do you have a remote team that needs easy, mobile-friendly ways to track their time and expenses?

Answering these helps you build a "must-have" list. This list becomes your guide, making sure you don't get distracted by flashy features that you'll never actually use.

Consider Future Scalability

The software that works for your five-person team today could become a serious bottleneck when you hit fifty. Scalability isn't just about adding more users; it's about whether the platform can handle more complex projects, bigger data volumes, and new business processes without grinding to a halt.

Think about your firm's five-year plan. Are you planning to launch new service lines? Open offices in different cities? The right billing software for professional services should be a partner in that growth, not a roadblock. A truly scalable solution grows with you.

Evaluate Integration Capabilities

Your billing software can't operate on an island. It needs to play nice with the other essential tools you rely on every day, like your accounting platform, CRM, and project management software. When systems don't talk to each other, you end up with frustrating data silos and force your team into mind-numbing manual data entry.

A well-integrated system creates a single source of truth for your financial and project data. When your CRM, project management, and billing tools are in sync, you gain a holistic view of your business health, from sales pipeline to final payment.

When you're looking at different options, check how they handle more advanced financial workflows, like integrations with or features similar to specialized invoice factoring software solutions. Strong integration capabilities are a hallmark of a mature, flexible platform. To see how some top contenders stack up, take a look at our guide on https://www.timetackle.com/the-best-time-tracking-and-billing-software-of-2023-2/.

Prioritize the User Experience

Let's be honest: the most powerful software on the planet is worthless if your team hates using it. A clunky, confusing user experience (UX) leads directly to spotty time tracking, inaccurate data, and seriously frustrated employees. You need a tool that feels intuitive—one that makes their lives easier, not harder.

Don't skip the trial period, and make sure your whole team gets in on it. Let the people who will be in the software every day—your consultants, project managers, and admins—give it a real-world test drive. If they can track their time and submit expenses with minimal training, you've probably found a winner. A clean, friendly interface is non-negotiable.

Analyze Pricing Models Carefully

Finally, you have to look beyond the sticker price and understand the total cost of ownership. Software vendors get creative with their pricing, so it's vital to find a model that works for your firm's finances.

Here are the most common models you'll run into:

- Per-User, Per-Month: This is a classic subscription model where you pay a flat fee for each person. It’s predictable but can get pricey as your team grows.

- Tiered Pricing: You'll see plans with different feature sets at different price points. Just make sure the tier you pick has everything you need without making you pay for a bunch of extras you won't use.

- Usage-Based Pricing: Some platforms might charge based on how many invoices you send or the number of active clients you manage.

Always be on the lookout for hidden fees, like charges for implementation, training, or premium support. The best value isn't always the cheapest option upfront; it's the one that gives you the biggest return on your investment over the long haul.

Integrating Billing Software into Your Workflow

Picking the right platform is a huge first step, but the real magic of billing software for professional services happens when you actually implement it. A thoughtful integration plan is what makes the software feel like a natural extension of your team, not just another tool you have to log into.

This is what separates a smart investment from an expensive mistake.

Think of it like upgrading an old house's electrical system. You don’t just plug new gadgets into old outlets and hope for the best. You need a solid plan to rewire everything for peak efficiency, all without disrupting the people living inside. That's exactly what you're doing here—weaving this new system into the very fabric of your firm.

Charting Your Path to a Seamless Transition

If there’s one rule in tech implementation, it’s this: preparation prevents poor performance. A smooth rollout lives or dies by a clear, step-by-step roadmap that considers your data, your people, and your existing processes. A messy, "we'll figure it out later" approach just amplifies old problems.

A structured plan, on the other hand, magnifies efficiency right from the start.

A successful integration really comes down to four key pillars:

- Data Migration: Getting all your historical client and project data moved over cleanly.

- Team Onboarding: Training your team not just on how to use the tool, but why it makes their lives easier.

- Workflow Automation: Setting up automated rules to grab those efficiency gains immediately.

- System Connectivity: Linking the new software with the other tools you already use.

Migrating Your Data Without the Headaches

All that client information, project history, and past billing data? That’s gold. The migration process is your chance to do some spring cleaning, making sure only accurate, relevant data makes it into your shiny new system. Start by auditing your current data for duplicates, old contacts, and incomplete records.

Once you’ve tidied up, import the important stuff methodically. Focus on active clients and ongoing projects first to keep business running smoothly. This foundational step ensures your reports and invoices are spot-on from day one, which builds trust in the new system right away. For firms juggling a ton of client work, combining this cleanup with the right tools is crucial; you can find out more about how project management and billing software work together on timetackle.com.

Training Your Team for Immediate Adoption

The true test of any new software is whether people actually use it. Your team needs to see it as a tool that genuinely simplifies their work, not one that adds another layer of complexity. The secret is to tailor your training to their specific roles.

Show project managers how they can track budgets in real-time. Show consultants how mobile time tracking saves them from trying to piece together a timesheet on a Friday afternoon.

True adoption isn't just about showing people which buttons to click. It's about demonstrating how the new system solves their specific, everyday frustrations, turning them into advocates for the change.

Create a learning environment that’s supportive, with hands-on training sessions and easy-to-access resources like video tutorials or a quick-reference PDF. Don’t forget to celebrate the small wins and highlight how the tool is already making things better—that’s how you build momentum.

Connecting Your Broader Tech Stack

Last but not least, your billing software for professional services shouldn’t live on an island. It should be the financial hub that talks to all your other critical business systems. This is where you eliminate double-data-entry and get a single, clear view of your operations.

Make sure your new platform connects to essential tools like:

- Accounting Software (e.g., QuickBooks, Xero): This is non-negotiable. When an invoice gets paid, the transaction should automatically pop up in your general ledger. This makes financial reconciliation a breeze.

- CRM (e.g., Salesforce, HubSpot): Syncing client data between your CRM and billing software keeps all contact and contract details consistent, so sales and finance are always on the same page.

An interconnected ecosystem like this lets data flow where it needs to go, saving countless admin hours and giving leadership a clear, accurate picture of the business from the first conversation to the final payment.

The Future of Billing and Firm Management

Picking the right billing software for professional services isn't just about plugging a hole in your current workflow. It’s about finding a partner that will grow with your firm and adapt to the trends that are completely reshaping the professional services industry. The platforms of tomorrow are leaving simple invoicing in the dust, evolving into intelligent hubs for total firm management.

What's fueling this change? Technology, of course. We're seeing a massive shift from reactive billing—just recording things that already happened—to proactive financial management. The best software now anticipates your needs before you even realize you have them. This forward-looking approach is what will separate the thriving firms from those just trying to tread water in the years ahead.

The Rise of AI in Financial Forecasting

One of the biggest game-changers is the integration of Artificial Intelligence (AI). AI algorithms can now dig into your firm's historical data—project timelines, client payment cycles, team utilization rates—and spit out remarkably accurate cash flow forecasts. Imagine knowing, with a high degree of confidence, what your bank balance will look like three months from now.

That kind of predictive power lets you make much smarter calls on hiring, investing in new tools, or expanding your services. AI is also taking over tedious tasks like categorizing expenses and even suggesting the best time to send an invoice to get paid faster. It’s about turning your raw data into a real strategy.

Embedded Finance and Client-Centric Portals

Another trend you'll see more of is embedded finance. This is where your billing platform starts acting like a financial command center. Instead of just processing payments, it might offer integrated services like short-term business loans, corporate cards, or insurance—all without you ever having to leave the software. It creates a single, seamless ecosystem for your firm's finances.

At the same time, the client experience is finally getting the attention it deserves. Modern platforms are rolling out client-centric portals. Think of them as secure, self-service dashboards where your clients can see project updates, approve timesheets, pull up old invoices, and pay their bills, all in one spot.

This isn't just about getting paid faster. This level of transparency and convenience elevates the entire client relationship. It builds trust and positions your firm as a modern, easy-to-work-with partner.

This shift toward smarter, more connected solutions is why the market is blowing up. The global billing software sector is expected to more than double, growing from USD 11.28 billion to USD 23.69 billion by 2035. What's driving it? The very automation and cloud-based tools we're talking about. Read the full research about billing software market growth on Market Research Future. Choosing a platform that already has its eyes on these trends is the best way to make sure your firm is ready for whatever comes next.

Frequently Asked Questions

When you're digging into billing software for professional services, a few final questions usually pop up. Getting those last details ironed out is what helps you make a choice you’ll be happy with for the long haul. Let's tackle some of the most common ones we hear.

Can Billing Software Handle Different Billing Models?

You bet. In fact, this is one of their biggest strengths. Modern billing platforms are built from the ground up to handle the flexible ways professional service firms bill for their expertise.

- Hourly Rates: Easily set different rates for specific team members, roles, or even certain types of tasks.

- Fixed-Fee Projects: Bill clients based on project completion or specific milestones you've both agreed on.

- Retainers: Put recurring monthly or quarterly invoices on autopilot for ongoing client work. This alone is a huge time-saver.

The really good systems even let you mix and match these models for the same client, giving you the freedom to structure your agreements in a way that just makes sense for the project at hand.

Is My Financial Data Secure in Billing Software?

This is non-negotiable, and any software provider worth their salt makes security their top priority. Your financial and client data is incredibly sensitive, and the best platforms guard it with serious security measures. Always look for software that offers bank-level encryption to protect your information, both when it's being sent and when it's stored.

Reputable platforms often have certifications like SOC 2 or are GDPR compliant, which shows they're truly committed to protecting your data. Many also offer role-based access controls, letting you decide exactly who on your team can see or change sensitive financial information.

How Is This Different from My Accounting Software?

It's a great question, and there's a simple way to think about it: it's the difference between a general practitioner and a specialist. While your accounting software probably has a basic invoicing button, specialized billing software for professional services goes much, much deeper.

Your accounting software is designed to look after the overall financial health of your company—think chart of accounts, P&L statements, and balance sheets. Billing software, on the other hand, is hyper-focused on the entire lifecycle of your client work. This means it handles things like detailed time tracking, expense management with receipt capture, project profitability reporting, and juggling complex billing rates.

The two systems aren't meant to compete; they're designed to integrate and work together, giving you a powerful, end-to-end view of your firm's finances.

Ready to eliminate timesheet fatigue and gain real-time visibility into your firm's profitability? TimeTackle provides the AI-powered insights you need to make smarter decisions and drive growth. Discover a better way to manage your most valuable resource—time—by visiting https://www.timetackle.com today.