Figuring out an hourly rate seems simple enough: just divide an annual salary by the total hours worked in a year, right? Unfortunately, this basic formula is a trap that leads countless businesses to undercharge for their services.

Why Your Simple Hourly Rate Is Costing You Money

If you're just dividing an annual salary by 2,080 hours, you are almost certainly losing money on every single project. It's an incredibly common mistake, but one that keeps agencies stuck in survival mode instead of actually thriving.

This method feels logical on the surface, but it completely ignores the financial realities of running a business. Small oversights, like forgetting to account for software subscriptions or non-billable meeting time, add up fast. Each one creates a hidden revenue gap, meaning you're essentially funding parts of your business out of your own pocket rather than building those costs into your pricing.

The Hidden Costs in a Simple Calculation

The most common error I see is underestimating—or completely forgetting—all the non-billable time. Client work is just one piece of the puzzle. Your team also spends hours in internal meetings, on administrative tasks, and in training sessions. All of this is essential to keep the business running, but none of it is directly billable to a client.

Beyond that, other costs are silently eating away at your profits:

- Overhead Expenses: This is everything from office rent and utilities to the software you rely on, like project management tools and your CRM.

- Employee Benefits: Things like health insurance, retirement contributions, and payroll taxes can easily add an extra 20-30% on top of an employee's base salary.

- Profit Margin: Your rate must include a healthy margin for growth, reinvestment, and simple financial stability. If it doesn't, you’re just breaking even, which isn't a sustainable way to operate.

A truly profitable rate is built on four pillars: base salary, overhead, utilization, and profit. Getting this formula right isn't just about making more money—it's the foundation of a financially healthy agency.

To avoid hidden liabilities and make sure your calculations align with legal requirements, it's worth diving into a comprehensive guide to FLSA regulations. Properly classifying employees and following wage laws is critical for both your financial and legal security. Moving beyond a simple rate calculation is the first step to protecting your business and setting it up for real, sustainable growth.

Figuring Out Your Foundational Billable Rate

To set an hourly rate that actually protects your profit margin, you have to start with a solid foundation. This means getting real about how many hours your team can actually bill to clients, instead of just relying on the generic 2,080 hours in a standard work year. Nailing this foundational rate is the first—and most critical—step to understanding the true cost of your team's time.

The whole process kicks off by figuring out an employee's realistic, available work hours. This isn't just about what's in their contract; it's about subtracting all the non-billable time that’s just a normal part of doing business.

Defining Actual Billable Hours

Before you even think about plugging numbers into a formula, you need an accurate denominator. An employee's total time on the clock isn't the same as their time available for client work. You have to account for all the hours that aren't billable.

Think about all the non-client work that happens in a given year:

- Paid Time Off (PTO): All those well-deserved vacation days and personal time.

- Company Holidays: Every official day the business is closed.

- Sick Leave: An average number of sick days you expect per employee.

- Training and Development: Time you've set aside for them to grow their skills.

- Internal Meetings: Don't forget the all-hands, team check-ins, and other administrative huddles.

Once you subtract this time from the total 2,080 hours, you’re left with a much clearer picture of an employee’s true capacity for client-facing work.

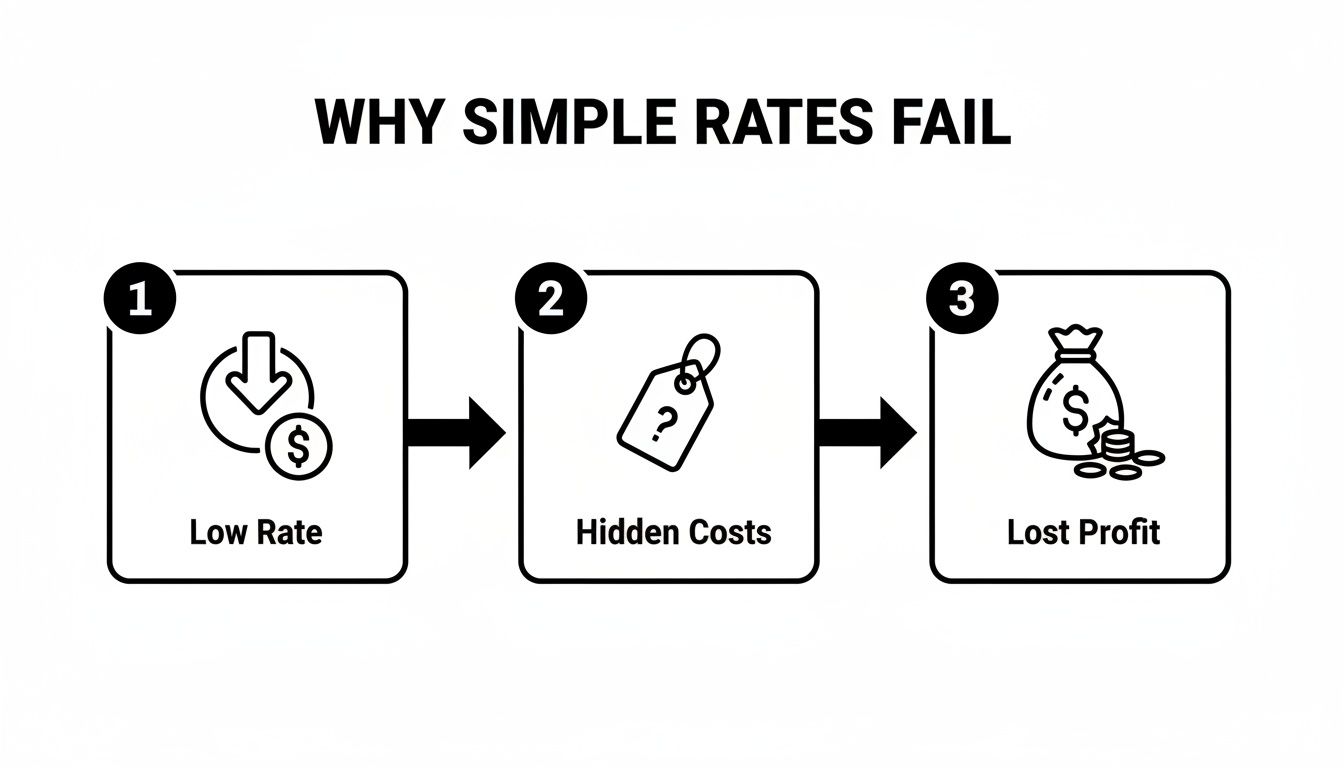

This is where so many agencies get it wrong. They start with a simple, low rate that looks good on paper but quickly leads to financial trouble when reality hits.

As you can see, this common pitfall—failing to account for the true cost of doing business—is a direct path to eroding your profitability.

To put this into perspective, let's walk through how to calculate an employee's actual billable hours for the year.

Calculating Realistic Annual Billable Hours

| Time Component | Hours | Calculation |

|---|---|---|

| Total Annual Work Hours | 2,080 | 40 hours/week x 52 weeks |

| Paid Time Off (PTO) | -80 | 10 days x 8 hours/day |

| Company Holidays | -80 | 10 days x 8 hours/day |

| Sick Leave (Average) | -40 | 5 days x 8 hours/day |

| Internal Meetings/Admin | -80 | ~1.5 hours/week |

| Total Available Hours | 1,800 | The realistic number of hours an employee is available to work. |

This table clearly shows how quickly those standard 2,080 hours shrink. The 1,800 available hours is a much more realistic number to use for any further calculations.

Applying a Utilization Target

But wait, there's more. Even with those 1,800 available hours, no employee is going to spend 100% of that time on billable tasks. That’s just not how it works. This is where a utilization target becomes essential.

This metric is the percentage of an employee's available time that you can realistically expect to be billed to clients. It accounts for all the little things that eat up time but aren't tied to a specific project—like bathroom breaks, quick chats with colleagues, or just staring into space thinking about a problem.

For example, a project manager at a creative agency earning $120,000 annually might have a utilization target of 75%. If their real available hours are 1,800 per year, their target billable hours are actually 1,350 (1,800 x 0.75).

That's a massive difference from the original 2,080 hours, and it will dramatically impact the hourly rate you need to charge to be profitable.

Getting this right is fundamental, especially for agencies battling timesheet fatigue and burnout. For a deeper dive into the numbers, check out our complete guide on the labor cost formula.

By using a realistic utilization target, you ensure your baseline rate reflects how your team actually operates, preventing you from underbilling before a project even starts.

Incorporating Hidden Costs Like Overhead and Benefits

A foundational billable rate that only covers an employee's salary is a recipe for disaster. It completely ignores the real costs of keeping the lights on. I've seen it time and time again: underbilling is a massive issue for agencies, and it almost always happens because those silent, indirect costs of running the business get left out of the equation.

These are the expenses that don't belong to a single project but are absolutely essential for your team to do their work. To build a truly profitable rate, you have to move beyond just salary and look at the bigger financial picture.

Identifying Your Total Overhead Costs

Overhead includes all the ongoing business expenses not directly tied to a specific client project. Think of these as the bills you have to pay even if you have zero active projects for a month.

Get a handle on this by listing out all these expenses on an annual basis:

- Office Space: Rent or mortgage payments.

- Utilities: Electricity, internet, water, and heating/cooling.

- Software and Subscriptions: All your tools—CRM, project management, accounting software, you name it.

- Administrative Salaries: Pay for non-billable roles like office managers, HR, and internal finance staff.

- Professional Services: Those necessary fees for lawyers, accountants, and consultants.

- Insurance: General liability, E&O, and other business policies.

Once you've tallied up your total annual overhead, you can calculate an "overhead-per-hour" cost to bake into each employee's rate. For a deeper dive into this process, check out our guide on https://www.timetackle.com/how-to-calculate-operating-expenses/.

Key Takeaway: The goal is to distribute the cost of running the business fairly across every billable hour your team works. This ensures that every project contributes to keeping the company healthy, not just covering salaries.

Factoring in Employee Benefits

The next huge piece of the puzzle is employee benefits. An employee's salary is just one part of their total compensation package. Benefits like health insurance, retirement contributions, and payroll taxes are significant expenses that can easily add 20-30% to your total labor costs. Forgetting these is like giving away a huge chunk of your services for free.

In the consulting world, this is a classic pitfall that often costs firms 15-20% in lost revenue annually.

Let’s look at a real-world example. A team lead earning a $110,000 salary might have 30% in benefits ($33,000) and 25% in overhead ($27,500). This brings their total annual cost to a whopping $170,500. Assuming 1,400 billable hours, their true cost per hour is $121.79—miles away from the $78.57 you'd get from looking at salary alone.

Putting It All Together for a True Cost Rate

With all these components in hand, you can build a comprehensive formula that reveals the true cost of an hour of your team's time.

- Calculate Total Employee Cost: Start with the basics:

Annual Salary + Annual Cost of Benefits. - Determine Total Overhead Per Employee: Divide your total overhead by your team size:

Total Annual Overhead / Number of Billable Employees. - Find the Fully Loaded Cost: Add everything up for one person:

Total Employee Cost + Overhead Per Employee. - Calculate the True Hourly Cost Rate: Finally, divide by their workable hours:

Fully Loaded Cost / Annual Billable Hours.

Following this method gives you a rate that actually reflects the full investment required to deliver high-quality work. It’s how you protect your margins and set your agency up for long-term financial success.

How to Build a Healthy Profit Margin into Your Rate

Covering your costs is just the starting line. Profit is what actually fuels your agency's growth and stability. Once you've figured out your fully-loaded cost rate, it's time to add a strategic profit margin.

This isn’t about plucking a number out of thin air. It’s a critical business decision that needs to align with your financial goals, your position in the market, and the real value you deliver to clients. Too many agencies just slap on a standard markup without much thought, but a more deliberate approach is what keeps you competitive while building a business that lasts. The right margin protects you from scope creep and unexpected costs, funds your future growth, and fairly compensates you for the risk and effort you put in every day.

Choosing Your Profit Margin Model

Your profit margin should directly reflect the unique value your services provide. A common approach is to add a 20-30% markup to your fully-loaded cost rate. For most service businesses, this range hits a sweet spot between profitability and staying competitive.

So, if your true hourly cost works out to $120, tacking on a 25% margin ($30) brings your final billable rate to $150. Simple as that.

Part of building a healthy margin is picking the right framework. Exploring something like a cost-plus pricing strategy can be really helpful here. It gives you a systematic way to add your desired profit to your base costs, ensuring every single hour you bill contributes directly to your bottom line.

But remember, a one-size-fits-all approach rarely works in the real world. You need to consider a few other things:

- Industry Benchmarks: Do some digging. See what similar agencies in your niche are charging. You don't have to copy them, but it gives you crucial context for where you fit in.

- Service Value: Are you offering high-impact, specialized services like strategic consulting? You can—and should—justify a higher margin, maybe 40% or more. The greater the ROI you deliver for your client, the more of that value you deserve to capture.

- Market Demand: If your agency has a stellar reputation and your services are in high demand, you have more leverage to command a premium. Don't be afraid to use it.

Communicating Value Beyond the Hour

Ultimately, the most successful agencies I've seen are the ones who shift the client conversation away from "hours worked" and toward "results delivered." When you can confidently articulate the ROI and business outcomes you generate, the hourly rate becomes a secondary detail.

Key Insight: Your profit margin isn’t just a number; it’s a reflection of your confidence in the value you create. Frame your pricing discussions around the problems you solve and the goals you help clients achieve, not the time it takes to do so.

Adopting this value-based mindset is what allows you to set a profitable rate that supports your agency's long-term health. It moves you from being just another vendor to a trusted partner whose impact is measured in outcomes, not just hours on a timesheet.

Refining Your Rates with Real-Time Data

A perfectly crafted formula is only as good as the numbers you plug into it. If your calculations rely on old spreadsheets or, even worse, manual timesheets, your hourly rate is built on guesswork. Not reality. This is where the real work begins: refining your rates with accurate, real-time data so they reflect how your team actually spends its time.

Let's be honest, the traditional model of chasing down timesheets is broken. It’s slow, often wrong, and a major headache for everyone involved. A much smarter approach comes from modern tools that sync directly with your team’s calendars. By automatically capturing every meeting, call, and work block, you get a crystal-clear, unbiased picture of time allocation across the business.

This is the first step to finally ditching assumptions and getting a true measure of billable versus non-billable hours.

Automating Data Capture for Pinpoint Accuracy

The real magic happens when you layer automation on top of this captured data. Instead of expecting your team to manually categorize every single calendar event, you can set up rules to do the heavy lifting for them.

Imagine automatically tagging all internal syncs as "Non-Billable Admin" or every client-facing call with the correct project name. This is a huge leap forward, turning raw calendar data into a clean, structured dataset that’s actually ready for analysis.

This process drastically improves the accuracy of one of the most critical metrics in your hourly rate calculation: the utilization rate. To get a better handle on this, check out our guide on how to calculate utilization rate.

Using Dashboards to Uncover Real Utilization

Once your time is accurately captured and sorted, analytics dashboards are where the insights come to life. You can instantly see precise utilization rates for each team member, department, or even specific projects. This kind of visibility is invaluable.

You might discover a senior designer is spending 15% of their week in non-billable internal meetings—a hidden cost your old rate never accounted for. Or you might find a junior developer with a surprisingly high billable percentage, a clear sign they're ready for more responsibility.

Real-time data doesn’t just refine your calculations; it reveals operational truths. It shows you exactly where time is being invested and where it's being lost, allowing you to make data-driven decisions about resource allocation and project profitability.

This dynamic approach is vital because costs are never static. Historical salary trends show that wage growth often outpaces inflation, silently eating away at your margins if rates don't keep up. For instance, FRED data shows that U.S. private sector average hourly earnings climbed from $36.37 in August 2025 to $36.94 by December. For COOs, syncing this kind of real-time data allows for instant recalibrations based on actual costs.

The final piece of the puzzle is connecting this live data back to your financial models. With a tool like TimeTackle, you can easily export this clean utilization data or sync it directly with Google Sheets. This creates a seamless flow where your rate calculation spreadsheets are always fed by the most current, accurate information, ensuring your answer to "how to calculate hourly rate" is always based on reality.

Even with the right formulas in your back pocket, applying them to the real world of agency life can get… complicated. Let's walk through some of the most common questions and sticky situations that come up when setting your hourly rates.

Getting a handle on these practical details is what separates a pricing strategy that looks good on paper from one that actually works.

How Often Should I Recalculate My Agency's Hourly Rates?

The short answer? You need to do a full-blown review of your rates at least once a year. This is your chance to factor in all the standard shifts in your business—think annual salary bumps, new software costs, or changes to employee benefits.

But don't just set it and forget it for a whole year. Things change fast. You should be keeping an eye on your project profitability every quarter. If you bring on a new team, make a big investment in technology, or just notice your project margins are consistently slipping below your target, that’s your signal to recalculate immediately.

Think of a tool with real-time utilization data as your early warning system. It helps you catch trends that could hurt your bottom line long before they show up on a quarterly P&L, letting you be proactive instead of reactive.

What Is a Blended Rate and When Should I Use It?

A blended rate is a single, averaged hourly rate you charge a client for a project, regardless of who does the work—be it a senior strategist or a junior designer. It definitely makes proposals and invoices simpler, which can be a huge plus for you and your client.

But there's a catch. If your senior (and more expensive) people end up clocking more hours on the project than you planned, your profit margin can evaporate in a hurry.

A blended rate works best on projects where you have:

- A predictable mix of senior and junior tasks.

- A ton of confidence in your time estimates.

- A client who really values simple, straightforward billing.

I’d be very cautious about using it for complex or unpredictable projects where the scope could creep, demanding more time from your senior-level talent.

How Do I Price for Freelancers or Subcontractors?

This one’s critical: treat your freelancer and subcontractor costs as a direct project expense. Don't lump them in with your general company overhead. It keeps your project profitability crystal clear.

The math is pretty simple. Take their hourly or project fee and add a markup—typically somewhere between 15-30%—before you bill it to the client. So, if a freelance developer costs you $80/hour, you might bill them out at $100/hour.

That markup isn't just gravy. It covers the real, and often invisible, work you're doing:

- The project management time you spend managing their work.

- The administrative overhead of finding, onboarding, and paying them.

- The value you bring by vetting them and guaranteeing the quality of their work for the client.

Should I Raise My Rate to Compensate for Low Utilization?

No. Absolutely not. This is a tempting but dangerous trap that just papers over deeper problems in your agency. Jacking up your rate to cover for an inefficient team will quickly price you out of the market and make your proposals look uncompetitive.

Low utilization isn't a pricing problem; it's an efficiency or sales pipeline problem.

Instead of messing with your rate, dig into your time-tracking data to find the root cause. Are your projects poorly scoped, leaving people with downtime? Is your sales team struggling to keep the pipeline full, creating gaps between projects?

Once you fix the real issue and get your team’s utilization up, your correctly calculated rate will deliver the profit you need. Don't use your pricing as a band-aid for operational wounds.

Stop letting guesswork dictate your profitability. TimeTackle syncs with your team's calendars to provide the real-time utilization data you need for accurate hourly rate calculations. Make data-driven decisions and ensure every hour is accounted for. See how it works at TimeTackle.