In project management, cost isn't just the sticker price of the big-ticket items. It's the grand total of every single monetary resource you need to get a project from kickoff to completion. Think labor, materials, software licenses, that extra shot of espresso for the late-night crew—all of it. Nailing cost management is what separates a profitable project from a financial train wreck.

Why Project Cost Management Is Your Agency's Lifeline

Let's be honest: uncontrolled project costs are the silent killers of agency profitability.

Imagine your agency's finances as a bucket of water. Every new project starts with a full bucket. But without a close watch, tiny, unmanaged expenses become leaks. A few extra unbilled hours here, an unplanned software subscription there—each one slowly drains your resources. Before you know it, you're left staring at a nearly empty bucket and razor-thin margins.

This is why mastering cost in project management is less about bean-counting and more about strategic survival. It’s about making sure every dollar you put into a project actually works for you, protecting your agency from that all-too-familiar fate of working incredibly hard just to break even. To really get a handle on this, a solid understanding of cost accounting is your foundational first step.

The Real-World Impact of Poor Cost Control

When you let project costs run wild, the consequences are brutal. Cost overruns are a persistent nightmare in our industry, hitting a staggering average of 27% per project.

That means for every $100,000 you budget, you’re likely spending an extra $27,000 thanks to scope creep, surprise risks, or just plain poor planning. This isn't just a rounding error; it adds up to a global waste of around $1 million every 20 seconds.

For an agency, this isn't some abstract statistic. It's a direct hit that leads to:

- Eroded Profit Margins: Every dollar over budget is a dollar straight out of your pocket.

- Strained Client Relationships: Nobody likes having constant, tense conversations about the budget. It kills trust.

- Team Burnout: Your team ends up overworked, scrambling to fix problems that better financial planning could have prevented in the first place.

A Roadmap for Financial Health

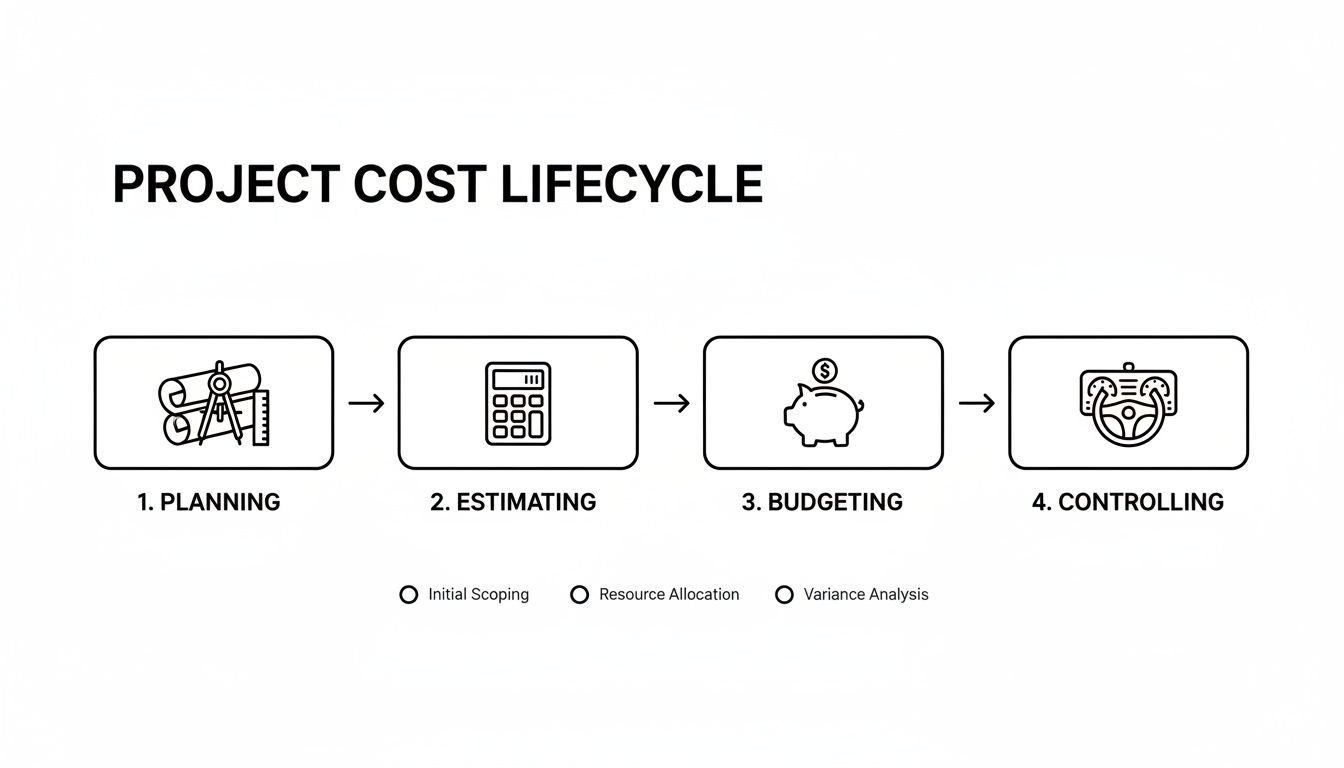

The good news? There’s a proven, four-part process to get this under control. True project cost management isn't a one-and-done task; it's a continuous cycle that gives you a clear roadmap to financial health. It’s about moving from reactive fire-fighting to proactive financial strategy.

This table breaks down the four core processes we'll be diving into. Think of it as your high-level guide to turning financial chaos into predictable profit.

| The Four Pillars of Project Cost Management |

| :— | :— | :— |

| Process | Core Objective | Key Outcome for Agencies |

| 1. Plan Cost Management | To establish the policies, procedures, and documentation for managing project costs. | A clear rulebook for how financial decisions will be made, approved, and tracked. |

| 2. Estimate Costs | To develop an approximation of the monetary resources needed to complete project activities. | Realistic, data-driven cost predictions that set the stage for profitable quotes. |

| 3. Determine Budget | To aggregate the estimated costs of individual activities to establish an authorized cost baseline. | A firm, approved budget that the project will be measured against. |

| 4. Control Costs | To monitor project status to update the project costs and manage changes to the cost baseline. | The ability to spot variances early, prevent overruns, and keep the project on track. |

And if you want to get a head start on the biggest cost component for most agencies, check out our guide on the https://www.timetackle.com/labor-cost-formula/ to see how it all fits together.

By mastering this lifecycle—planning, estimating, budgeting, and controlling—you turn financial management from a source of anxiety into a competitive advantage. This framework is your agency's true lifeline, ensuring that every project not only meets its creative goals but also strengthens your bottom line.

The Four-Step Framework for Controlling Project Costs

Effectively managing project costs isn't about being a hawk-eyed accountant who says "no" to everything. It’s about having a solid, repeatable game plan. Think of it as a playbook that shifts your agency from constantly putting out financial fires to being in proactive control of every project’s profitability.

This process breaks down into four logical stages—planning, estimating, budgeting, and controlling—that form the complete financial lifecycle of a project.

You can see how each step naturally flows into the next, building a strong foundation for what’s to come. This isn't a one-and-done task; it's a continuous cycle you'll repeat and refine.

1. Plan Cost Management

This is where you set the rules of the game before the first dollar is ever spent. The goal is to create a financial blueprint that clearly defines how your team will handle costs from start to finish.

For an agency, this means getting everyone on the same page about the nitty-gritty details:

- Units of Measure: Are we tracking our work in hours, days, or maybe even story points for our agile projects?

- Levels of Precision: Do we round costs to the nearest dollar, or are we tracking every last cent?

- Control Thresholds: At what point do we sound the alarm? For example, if we go 10% over budget on a task, does that automatically trigger a review?

Getting these policies down on paper creates a single source of truth. No more confusion between project managers and the finance team—everyone knows the plan.

2. Estimate Costs

With your rulebook in hand, it’s time to forecast the resources needed to get the job done. This is where art meets science. You're blending historical data from past projects with the expert judgment of your team to produce a realistic cost approximation.

This isn't just about pulling a single number out of thin air. It’s a detailed breakdown of every expense you can think of, from the direct costs like your team's labor and software licenses to the indirect costs like a portion of the office rent.

A project estimate is not a commitment. It's an educated guess based on what you know right now. This is the raw material you'll use to build the official budget.

3. Determine the Budget

Next, you take all those detailed cost estimates for individual tasks and roll them up to create the official project budget. But you don't just hit "sum" and call it a day.

This is where you add a contingency reserve—a crucial buffer to cover the "known unknowns." It’s your safety net for predictable risks that could pop up along the way.

The final number becomes your cost baseline. This is the approved, time-phased budget that you'll measure your project's performance against. So, if your estimates add up to $90,000, you might add a $10,000 contingency reserve, setting your cost baseline at a clean $100,000. That's now your official yardstick for success.

4. Control Costs

This final step is an ongoing process, not a one-time event. Controlling costs is all about actively monitoring where you stand financially, comparing actual spend against your baseline, and managing any changes to keep the project on track.

It’s a proactive loop that looks something like this:

- Monitor Performance: Keep a close eye on where the money is actually going, ideally with real-time data from your time tracking and expense tools.

- Identify Variances: Catch deviations from the baseline early. You might notice the design phase has burned through 75% of its budget but is only 50% complete—that’s a red flag.

- Take Corrective Action: Step in and make adjustments to get back on course. This could mean reallocating resources, tightening up the scope, or finding other efficiencies before a small problem becomes a budget-killer.

By consistently following this four-step framework, you turn project financials from a source of anxiety into a powerful tool for driving profitability. You're no longer just managing costs; you're mastering them.

Choosing the Right Cost Estimation Technique for Your Agency

Let's be honest: accurate bids are what protect your margins and help you land the right kind of clients. Moving past simple guesswork isn't just a good idea; it's essential for getting a real handle on the cost in project management. Picking the right estimation technique gives your team a practical toolkit, ensuring your proposals are both competitive and genuinely profitable.

Think of these techniques as different tools for different jobs. You wouldn’t use a sledgehammer to hang a picture, and you definitely shouldn't rely on a quick gut-check for a complex, multi-phase project. Let’s break down the three most effective methods agencies have in their arsenal.

Analogous Estimating: The Quick Comparison

Analogous estimating is your go-to "back-of-the-napkin" calculation. It’s like saying, "The last time we built an e-commerce site like this, it took about 400 hours, so let's start there." It simply uses historical data from a similar past project as a baseline.

This method is super fast and doesn't require a mountain of data, making it perfect for those early-stage conversations where you have limited information. The tradeoff? It lacks precision. No two projects are ever truly identical, so it's a starting point, not a final number.

- Best For: Quick, high-level estimates for initial client conversations or ballpark figures.

- Agency Example: A potential client hops on a discovery call and asks for a rough idea of what a standard five-page brochure website costs. You can instantly pull from three similar sites you built last year to give them a confident range.

Parametric Estimating: The Statistical Approach

Parametric estimating takes the analogous method and makes it smarter by leaning on statistics. Instead of just comparing one whole project to another, you use historical data to figure out a cost per unit.

For example, your past project data might reveal that, on average, it costs your agency $500 to design and develop a single product page for an e-commerce store. If a new client needs a site with 40 product pages, you can do the math: 40 pages x $500/page gives you a $20,000 estimate for that specific deliverable. It's worlds more accurate than a simple project-to-project guess.

By using historical data to establish a rate, parametric estimating lets your forecasts scale with the project's variables. This gives you a much more reliable and defensible estimate than just going with your gut.

Bottom-Up Estimating: The Detailed Breakdown

Bottom-up estimating is the most granular—and most accurate—method of them all. This is where you roll up your sleeves and break the entire project down into its smallest individual tasks, estimating the cost for each tiny piece. Once you're done, you add up all those micro-estimates to get the total project cost.

Sure, it's time-intensive. But it delivers the most detailed and bulletproof forecast possible. It forces you and your team to think through every single step, from the initial kickoff meeting to the final QA testing. This level of detail is also a critical part of more advanced costing methods. If you want to dig deeper into how these tasks add up, our guide on what activity-based costing is offers some great insights.

- Best For: Creating detailed statements of work (SOWs) and formal project budgets you can stand behind.

- Agency Example: To quote a complex custom software integration, your team lists out every single task: API research (10 hours), user authentication setup (20 hours), data mapping (25 hours), and so on. Each task gets an estimate, and the totals are summed up for a comprehensive, no-surprises budget.

Beyond just managing your current projects, mastering cost estimation is fundamental to preparing bids that win new contracts. For a wider view on positioning your agency for success, check out this practical guide to winning a tender. By getting these techniques down, your agency can stop hoping for profitability and start planning for it with total confidence.

Keeping Tabs on Project Financial Health with a Few Key Formulas

Once your project is up and running, you need a way to check its financial pulse. Just looking at how much you've spent versus the budget doesn't cut it—that's like driving a car by only looking at the fuel gauge. It doesn’t tell you if you're actually getting good value for the money you're burning through.

This is where a few battle-tested formulas from Earned Value Management (EVM) come into play. Think of them as your project's dashboard. They stop you from guessing about performance and start giving you hard data to make smart decisions, letting you spot trouble long before it becomes a five-alarm fire.

And spotting trouble early is crucial. Poor project performance isn't just a minor headache; it's a massive financial drain. On average, organizations lose a staggering 9.9% of every dollar they invest due to things like rework, scope creep, and other inefficiencies. If a company spends $100 million a year on projects, that's nearly $10 million vanishing into thin air. You can discover more insights about project performance statistics to see just how widespread this problem is.

Calculating Cost Variance (CV)

The first vital sign to check is your Cost Variance (CV). This formula gives you a straight answer, in dollars and cents, to the question: "Are we over or under budget for the work we've actually done?"

The math is simple:

CV = Earned Value (EV) – Actual Cost (AC)

- A positive CV means you're under budget. Pop the champagne (or at least breathe a sigh of relief).

- A negative CV means you're over budget. Time to roll up your sleeves and figure out why.

Example in Action:

Imagine your agency is building a new website for a client, with a total budget of $50,000. You're about halfway through. The Earned Value—the real value of the design and coding work completed so far—is $25,000. But when you check the books, you see you've already spent $30,000.CV = $25,000 (EV) – $30,000 (AC) = -$5,000

That -$5,000 is a blinking red light. It tells you, without any ambiguity, that you are over budget for the work you've finished.

Measuring Cost Performance Index (CPI)

While CV shows you the dollar amount, the Cost Performance Index (CPI) gives you an efficiency rating. It's a ratio that answers the all-important question: "Are we getting our money's worth?"

Here's how you figure it out:

CPI = Earned Value (EV) / Actual Cost (AC)

- A CPI greater than 1.0 is great. It means for every dollar you spend, you're generating more than a dollar in project value.

- A CPI less than 1.0 is a problem. It shows you're spending more than the work is actually worth at this point.

Let's stick with our website project example:

CPI = $25,000 (EV) / $30,000 (AC) = 0.83

A CPI of 0.83 tells you that for every dollar you've put into this project, you've only gotten 83 cents of value out of it. It's a powerful metric that cuts right to the heart of your team's financial efficiency.

Forecasting with Estimate at Completion (EAC)

Finally, let's talk about the future. The Estimate at Completion (EAC) is like your project's financial crystal ball. It helps you forecast the total cost of the project if the current performance trend continues.

One of the most common ways to calculate it is:

EAC = Budget at Completion (BAC) / CPI

For our $50,000 project:

EAC = $50,000 (BAC) / 0.83 (CPI) = $60,241

This is the number that should make everyone sit up and pay attention. If nothing changes, this project isn't going to cost $50,000 anymore. It's on track to cost over $60,000. Armed with this forecast, you can stop hoping for the best and start taking concrete steps to get the budget back under control.

How to Automate Cost Management and Eliminate Busywork

Let’s be honest: the powerful theories behind cost in project management fall apart if they’re built on shaky data. Cumbersome spreadsheets and manual data entry just don't cut it anymore. They're slow, prone to human error, and a massive time sink.

It's time to trade in that old-school approach for smarter, automated workflows that give you back countless hours once lost to administrative busywork.

For any agency or professional service firm, the biggest challenge is accurately capturing your primary cost driver: time. We've all seen traditional timesheets fail. They rely on memory, feel like a chore, and almost always lead to guesstimates. This is where a fundamental shift in your process can change everything.

Calendar-Based Time Capture

Instead of nagging your team to fill out a timesheet, what if you could pull data from a source they already use all day, every day? Their work calendar.

Every meeting, client call, and focused work block is already there. Automated tools can tap directly into this existing data, creating a highly accurate, passive log of how time is being spent—without adding another tedious task to your team’s plate. This finally solves the problem of timesheet fatigue and ensures the data feeding your cost formulas is actually reliable.

Smart Tagging and Rule-Based Automation

Capturing time is just the first step. The real magic happens when you categorize it. Manually tagging every calendar event is slow and inconsistent, but automation flips the script. You can set up simple rules that do the heavy lifting for you.

Here’s how it works:

- Client Rules: Any calendar event with a client's domain in the attendee list (e.g., @clientcompany.com) can be automatically tagged with that client's name.

- Project Keywords: Events containing phrases like "Q3 Campaign" or "Website Redesign" can be instantly assigned to the correct project code.

- Activity Types: Meetings titled "Daily Stand-up" or "Internal Review" can be automatically flagged as non-billable time.

This level of automation doesn't just save time; it creates the structured, clean data you need for truly accurate cost analysis. It’s the engine that powers real-time visibility into project profitability. If you're looking to get started, you can learn more about how to automate repetitive tasks and build a more efficient system.

To highlight the difference, let's compare the old way with the new.

Manual vs Automated Cost Tracking

| Task | Manual Method (e.g., Spreadsheets) | Automated Method (e.g., TimeTackle) |

|---|---|---|

| Time Logging | Employee tries to recall and manually enter hours at the end of the day/week. Prone to errors and guesstimates. | Time is captured passively and accurately from existing calendar events. No extra work for the team. |

| Categorization | Manually assigning each time entry to a client, project, and task. Inconsistent and tedious. | Smart rules auto-tag events based on attendees, keywords, or meeting types. Ensures consistency. |

| Reporting | Manually compiling data from multiple timesheets into a master spreadsheet. Takes hours. | Real-time dashboards and reports are generated automatically with a few clicks. |

| Data Accuracy | Low. Relies on memory, leading to an estimated 15-20% inaccuracy in self-reported time. | High. Based on actual scheduled activities, providing a true reflection of time spent. |

| Admin Overhead | Significant. Requires constant reminders, data entry, and manual report building. | Minimal. The system runs in the background, freeing up managers to focus on strategy. |

This shift does more than just save a few hours; it transforms your ability to manage costs effectively.

When you integrate these automated tools with your CRM, you can connect time and cost data directly to sales opportunities and client accounts. This creates a unified view of the entire project lifecycle, allowing you to measure the true ROI of your work. Agency leaders finally get the real-time visibility needed to make strategic, data-driven decisions that ensure every project is as profitable as possible.

Frequently Asked Questions About Project Cost Management

When you're trying to nail down the financial side of a project, a few common questions always seem to pop up. Getting straight answers is the first step to confidently managing your project costs and protecting your agency's bottom line.

Let's walk through some of the most frequent queries we hear from agency leaders and project managers every day. We'll clear up any confusion and give you the practical takeaways you need.

What Is the Difference Between Project Cost and Project Price?

This is one of the most important distinctions in the entire business, but it's amazing how often the two get mixed up. The easiest way to think about it is like a bakery selling a cake.

Project cost is everything your agency spends to make the cake. It’s your internal investment—the sum of your team’s salaries, software licenses, overhead, and other direct expenses. It's the money going out your door.

Project price is what you charge the client for the finished cake. This is the number on the invoice you send them. Your profit margin is the gap between these two numbers. If you aren't accurately tracking your costs, you're just guessing at a price, and that's a dangerous game to play.

How Can We Prevent Scope Creep from Inflating Project Costs?

The best defense against scope creep is a good offense, and that starts long before a project ever kicks off. It all comes down to setting crystal-clear boundaries from the get-go and having a plan for when—not if—a client asks for more.

Here’s how you shut it down:

- Establish a Rock-Solid Scope: Your statement of work needs to be airtight. Spell out exactly what’s included and, just as importantly, what’s not included.

- Implement a Formal Change Control Process: When a new request comes in, don't just say yes. It needs to trigger a formal review that assesses its impact on cost, timeline, and resources before anyone agrees to it.

- Use Real-Time Tracking Tools: Modern tools show you the second that actual effort starts outpacing the original plan. This gives you the hard data you need to have a proactive conversation with the client before their "small request" eats your entire budget.

What Are the Most Common Hidden Costs in Agency Projects?

Hidden costs are the silent killers of profit margins. They’re the little things that fly under the radar, never get logged on a timesheet, and slowly bleed a project dry until it's too late.

Be on the lookout for the usual suspects: endless non-billable emails and calls with a client, internal admin tasks that weren't budgeted for, rework caused by vague feedback, and the slow drain from all those software subscriptions.

You have to acknowledge these "invisible" expenses exist and bake them into your budget from the start. Pretending they won't happen is just setting yourself up for an unprofitable project.

How Does Automated Time Tracking Improve Future Cost Estimates?

Automated time tracking is about so much more than just making payroll easier. It’s about building a historical database of your most valuable—and most expensive—asset: your team's time. By passively capturing granular, accurate data on current projects, you create an evidence-based foundation for every future proposal you write.

This treasure trove of data is what fuels smarter analogous and parametric estimates. Instead of pulling numbers out of thin air or relying on fuzzy memories of "a similar project," you can base your quotes on what things have actually cost in the past. This dramatically improves the accuracy of your bids, making them competitive enough to win the work and profitable enough to be worth winning.

Ready to eliminate guesswork and get a crystal-clear view of your project costs? TimeTackle uses the calendar data your team already creates to provide effortless, accurate insights into project profitability, team utilization, and operational efficiency. Stop chasing timesheets and start making data-driven decisions today at https://www.timetackle.com.